Automatic Sales Tax Calculator For Your Online Store

- Automatic Sales Tax Calculator For Your Online Store Near Me

- Automatic Sales Tax Calculator For Your Online Store Online

- Automatic Sales Tax Calculator For Your Online Store Free

- Automatic Sales Tax Calculator For Your Online Store Purchases

Other 2020 sales tax fact for Georgia As of 2020, there is 1 out of 632 cities in Georgia that charge city sales tax for a ratio of 0.158%. There is also 51 out of 1079 zip codes in Georgia that are being charged city sales tax for a ratio of 4.727%. Last sales taxes rates update. The last rates update has been made on July 2020. Sales Tax Calculator. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase. Sales tax is calculated by multiplying the purchase price by the sales tax rate to get the amount of sales tax due. The sales tax added to the original purchase price produces the total cost of the purchase.

Automatic Sales Tax Calculator For Your Online Store Near Me

The Sales Tax Calculator can compute any one of the following, given inputs for the remaining two: before-tax price, sale tax rate, and final, or after-tax price.

What is Sales Tax?

A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Usually, the vendor collects the sales tax from the consumer as the consumer makes a purchase. In most countries, the sales tax is called value-added tax (VAT), or goods and services tax (GST), which is a different form of consumption tax. In some countries, the listed prices for goods and services are the before-tax value, and a sales tax is only applied during the purchase. In other countries, the listed prices are after-tax final values, which includes the sales tax.

U.S. Sales Tax

In the United States, sales tax at the federal level does not exist. At the state level, all (including District of Columbia, Puerto Rico, and Guam) but five states do not have statewide sales tax. These are Alaska, Delaware, Montana, New Hampshire, and Oregon. States that impose a sales tax have different rates, and even within states, local or city sales taxes can come into play. Unlike VAT (which is not imposed in the U.S.), sales tax is only enforced on retail purchases; most transactions of goods or services between businesses are not subject to sales tax.

The sales tax rate ranges from 0% to 16% depending on the state and the type of good or service, and all states differ in their enforcement of sales tax. In Texas, prescription medicine and food seeds are exempt from taxation. Vermont has a 6% general sales tax, but an additional 10% tax is added to purchases of alcoholic drinks that are immediately consumed. These are only several examples of differences in taxation in different jurisdictions. Rules and regulations regarding sales tax varies widely from state to state.

On average, the impact of sales tax on Americans is about 2 percent of their personal income. Sales tax provides nearly one-third of state government revenue and is second only to the income tax in terms of importance as a source of revenue. Reliance on the sales tax varies widely by state. Sales taxes are much more important in the south and west than they are in New England and the industrial Midwest. Florida, Washington, Tennessee, and Texas all generate more than 50 percent of their tax revenue from the sales tax, and several of these states raise nearly 60 percent of their tax revenue from the sales tax. New York, on the other hand, only raises about 20 percent of its revenues from the sales tax.

The following is an overview of the sales tax rates for different states.

| State | General State Sales Tax | Max Tax Rate with Local/City Sale Tax |

| Alabama | 4% | 13.5% |

| Alaska | 0% | 7% |

| Arizona | 5.6% | 10.725% |

| Arkansas | 6.5% | 11.625% |

| California | 7.25% | 10.5% |

| Colorado | 2.9% | 10% |

| Connecticut | 6.35% | 6.35% |

| Delaware | 0% | 0% |

| District of Columbia | 5.75% | 5.75% |

| Florida | 6% | 7.5% |

| Georgia | 4% | 8% |

| Guam | 4% | 4% |

| Hawaii | 4.166% | 4.712% |

| Idaho | 6% | 8.5% |

| Illinois | 6.25% | 10.25% |

| Indiana | 7% | 7% |

| Iowa | 6% | 7% |

| Kansas | 6.5% | 11.5% |

| Kentucky | 6% | 6% |

| Louisiana | 4.45% | 11.45% |

| Maine | 5.5% | 5.5% |

| Maryland | 6% | 6% |

| Massachusetts | 6.25% | 6.25% |

| Michigan | 6% | 6% |

| Minnesota | 6.875% | 7.875% |

| Mississippi | 7% | 7.25% |

| Missouri | 4.225% | 10.85% |

| Montana | 0% | 0% |

| Nebraska | 5.5% | 7.5% |

| Nevada | 6.85% | 8.25% |

| New Hampshire | 0% | 0% |

| New Jersey | 6.625% | 12.625% |

| New Mexico | 5.125% | 8.688% |

| New York | 4% | 8.875% |

| North Carolina | 4.75% | 7.50% |

| North Dakota | 5% | 8% |

| Ohio | 5.75% | 8% |

| Oklahoma | 4.5% | 11% |

| Oregon | 0% | 0% |

| Pennsylvania | 6% | 8% |

| Puerto Rico | 10.5% | 11.5% |

| Rhode Island | 7% | 7% |

| South Carolina | 6% | 9% |

| South Dakota | 4% | 6% |

| Tennessee | 7% | 9.75% |

| Texas | 6.25% | 8.25% |

| Utah | 5.95% | 8.35% |

| Vermont | 6% | 7% |

| Virginia | 5.3% | 6% |

| Washington | 6.5% | 10.4% |

| West Virginia | 6% | 7% |

| Wisconsin | 5% | 6.75% |

| Wyoming | 4% | 6% |

U.S. History of Sales Tax

When the U.S. was still a British colony in the 18th century, the English King imposed a sales tax on various items on the American colonists, even though they had no representation in British government. This taxation without representation, among other things, resulted in the Boston Tea Party. This together with other events led to the American Revolution. Therefore, the birth of the U.S. had partly to do with controversy over a sales tax! Since then, sales tax has had a rocky history in the U.S. and this is perhaps why there has never been a federal sales tax. Some of the earlier attempts at sales tax raised a lot of problems. Sales tax didn't take off until the Great Depression, when state governments were having difficulty finding ways to raise revenue successfully. Of the many different methods tested, sales tax prevailed because economic policy in the 1930s centered around selling goods. Mississippi was the first in 1930, and it quickly was adopted across the nation. Today, sales tax is imposed in most states as a necessary and generally effective means to raise revenue for state and local governments.

How to Deduct Sales Tax in the U.S.

When filing federal income tax, taxpayers need to choose to either take the standard deduction or itemize deductions. This decision will be different for everyone, but most Americans choose the standard deduction because it is simpler and hassle-free. Sales tax can be deducted from federal income tax only if deductions are itemized. In general, taxpayers with sales tax as their only deductible expense may find that itemizing deductions is not worth the time. Itemizing deductions also involves meticulous record-keeping and can be tedious work because the IRS requires the submission of sales tax records, such as a year's worth of purchase receipts. Anyone who plans to itemize should be keeping detailed records, as it will be very helpful in determining the amount of sales tax paid.

After the choice between standard or itemized deductions has been made, taxpayers have to make another decision regarding whether or not to claim either state and local income taxes, or sales taxes (but not both). Most taxpayers choose to deduct income taxes as it typically results in a larger figure. With that said, it may be better for taxpayers who made large purchases during the year to deduct sales tax instead of income tax if their total sales tax payments exceed state income tax. Taxpayers who paid for a new car, wedding, engagement ring, vacation, or multiple major appliances during a tax year can potentially have a greater sales tax payment than income tax payment. In reality, less than 2% of Americans claim sales tax as a deduction each year.

For more information about or to do calculations involving income tax, please visit the Income Tax Calculator.

Value-Added Tax (VAT)

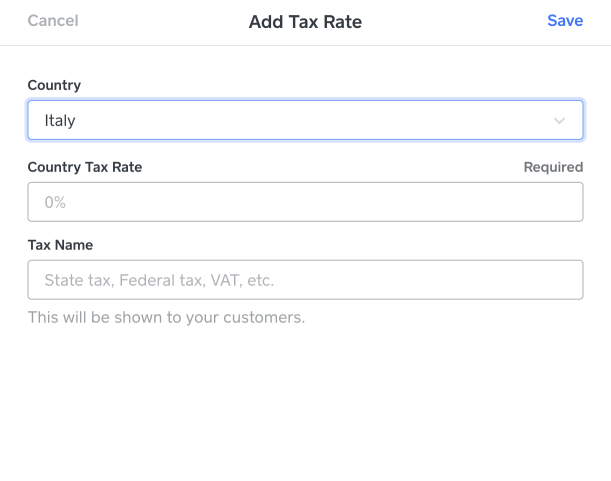

VAT is the version of sales tax commonly used outside of the U.S. in over 160 countries. VAT is an indirect tax that is imposed at different stages of the production of goods and services, whenever value is added. Countries that impose a VAT can also impose it on imported and exported goods. All participants in a supply chain, such as wholesalers, distributors, suppliers, manufacturers, and retailers, will usually need to pay VAT, not just the end consumer, as is done with U.S. sales tax. VAT can be calculated as the sales price minus the costs of materials or parts used that have been taxed already.

A 1979 study published by the Tax Foundation offered some insight into arguments for or against VAT as compared to sales tax. Perhaps the greatest benefit of taxation via VAT is that because taxation applies at every step of the chain of production of a good, tax evasion becomes difficult. Also, there are stronger incentives to control costs when all participants involved in a supply chain are taxed. Compared to sales tax, VAT has the ability to raise more revenue at a given rate. On the other hand, VAT tends to be regressive; that is, it takes proportionately greater amounts from those with lower incomes. Also, the cascading tax is harmful to new and marginal business activities, likely to set off inflationary tendencies, and is detrimental to exports. For more information about or to do calculations involving VAT, please visit the VAT Calculator.

Goods and Services Tax (GST)

The Goods and Services Tax (GST) is similar to VAT. It is an indirect sales tax applied to certain goods and services at multiple instances in a supply chain. Taxation across multiple countries that impose either a 'GST' or 'VAT' are so vastly different that neither word can properly define them. The countries that define their 'sales tax' as a GST are Spain, Greece, India, Canada, Singapore, and Malaysia.

Automatic Sales Tax Calculator For Your Online Store Online

If you’re an ecommerce retailer but struggle with sales tax, we’re here to help. Our easy-to-use software is designed to eliminate the pain and uncertainty surrounding online sales tax.

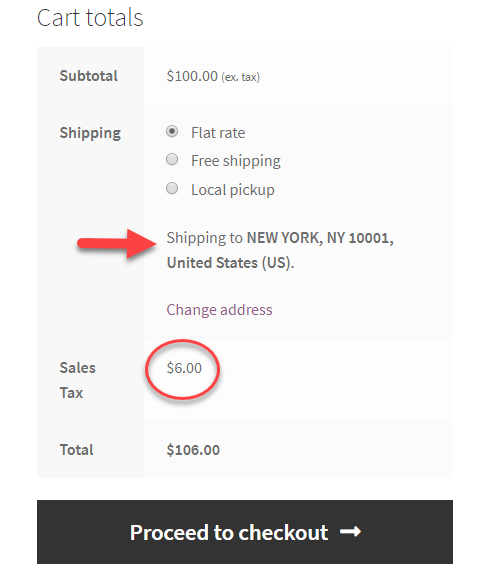

AccurateTax TaxTools connects with many major shopping carts. We provide the connector, which you install on your store, and it handles all of the communications between your website and our servers. We then calculate the right sales tax for each order in your store.

When it comes time to file your taxes, simply log into your account and our easy reports make filing your taxes a breeze.

Learn MoreAccurateTax is the easiest solution for managing sales tax collection and remittance for your e-commerce website. Sign up for a free trial of AccurateTax and find out how easy it is to get your sales tax calculations exactly right.

Why Choose AccurateTax for Your Ecommerce Sales Tax Solution?

Our sales tax software makes perfect sense. If you’re tired of dealing with the hassle of sales tax, you’re probably looking for ways to make that part of your business run more efficiently. Why would you choose AccurateTax over any other solution?

Free Trial, Easy Setup

AccurateTax is easy to use – just drop it into your shopping cart, enter your account information, and you’re off running. Get a free trial and see how AccurateTax simplifies your sales tax compliance.

Affordable at Any Size

Our tiered pricing means that you pay based on your usage, so smaller businesses have a lower cost than ones with a higher order volume. AccurateTax is affordable for almost every business.

Automatic Sales Tax Calculator For Your Online Store Free

Accurate Sales Tax Rates

You’ll find that our tax rates are accurate based on sourcing rules, addresses, product taxability, and other tax rules. Would you like to give it a try? Use our free sales tax calculator to test our rates.

Automatic Sales Tax Calculator For Your Online Store Purchases

A Focus on Sales Tax

We are committed to sales tax. You won’t find payroll taxes, income tax, or other financial services here. At AccurateTax, we do one thing, and we do it exceptionally well.

Streamlined Sales Tax Compliant

The Streamlined Sales Tax Project (SSTP) is a multi-state initiative to simplify sales tax for retailers and to provide free software. AccurateTax.com is a SSTP certified service provider.

No Setup Fees, No Commitment

We don’t charge you a setup fee to start using AccurateTax, and we don’t lock you into a long-term contract. This makes it easy to start using AccurateTax, and easy to quit…but we doubt you’ll have a reason to.

AccurateTax Works with the Software You Already Use

See all platforms

See all platformsSimplify Your Business. Get AccurateTax.

Use our sales tax calculator for accurate sales tax rates at the online point of sale – your website’s shopping cart. Streamline your operations by getting it right the first time, using tools designed to make life easier when it’s time to remit your sales and use taxes.